Income Tax 2025 Philippines. Prepare your income tax return. The tax tables below include the tax rates, thresholds and allowances included in the philippines tax.

The philippines taxes its resident citizens on their worldwide income. However, until june 30, 2025, the mcit is.

Calculate your annual take home pay in 2025 (that’s your 2025 annual salary after tax), with the annual philippines salary calculator.

How To Compute Tax In The Philippines Free Calculator APAC, The new income tax rates from year 2025 onwards, as per the train law, are as follows. A quick and efficient way to compare annual.

Latest BIR Tax Rates 2025 Philippines Life Guide PH, The tax tables below include the tax rates, thresholds and allowances included in the philippines tax. This 2025 tax calendar is designed to help you meet your tax obligations and to keep track of important tax dates during the year.

![[Ask the Tax Whiz] How to compute tax under the new tax](https://www.rappler.com/tachyon/2023/01/8.jpg)

[Ask the Tax Whiz] How to compute tax under the new tax, This 2025 tax calendar is designed to help you meet your tax obligations and to keep track of important tax dates during the year. How to pay tax online in the philippines in 2025:

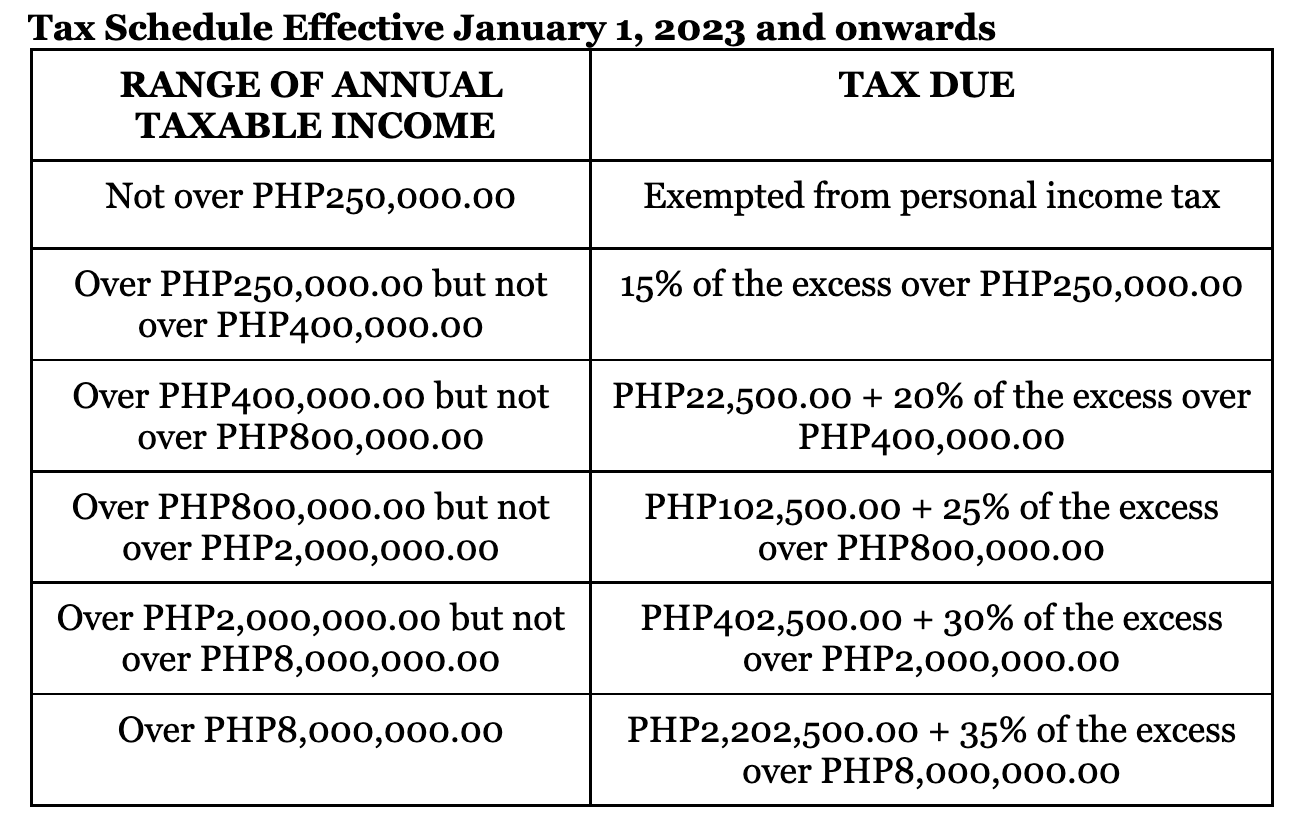

BIR Tax Schedule Effective January 1 2025, Susa tax manager, pwc philippines 24 jan 2025. The philippines taxes its resident citizens on their worldwide income.

![Tax 202324 FY [202425 AY] New IT Slab Rates Online Tax](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEj3RPHIvoGiyFMqYgzPepp7W-yacCgvnB_-QZrpBQqpUEem43puz5Do6OGV4HF7M87pTxpyGfFWOh8KT9mXdn0cASjSTLfRPT4iAxd3HUNAcYFHNLtvdPS0SAwskzdHBY1WJ9hPdoKwsD45ZZ64qc17JyAuzsPHMZCf_iA1JVrepCAanVrfrNtUCvUQ/w1200-h630-p-k-no-nu/Income Tax 2023-24 FY [2024-25 AY] Old & New Tax Slab Rates Online IT 2023-24 Calculator.png)

Tax 202324 FY [202425 AY] New IT Slab Rates Online Tax, To calculate income tax in the philippines: How to compute income tax in the philippines in 2025 (complete guide) step 1:

Payroll updates in 2025 to keep in mind CloudCfo, The corporate tax rate in the philippines is 25%, with a minimum corporate income tax (mcit) of 2% on gross income. You just need to enter your monthly income and then use the calculator to compute your taxable income, monthly tax due, and net.

NRI Tax 2025 What is the Tax Payable for NonResident Indians, How to pay tax online in the philippines in 2025: The new income tax rates from year 2025 onwards, as per the train law, are as follows.

Tax Relief 2025 Malaysia Printable Forms Free Online, The philippines taxes its resident citizens on their worldwide income. How to pay tax online in the philippines in 2025:

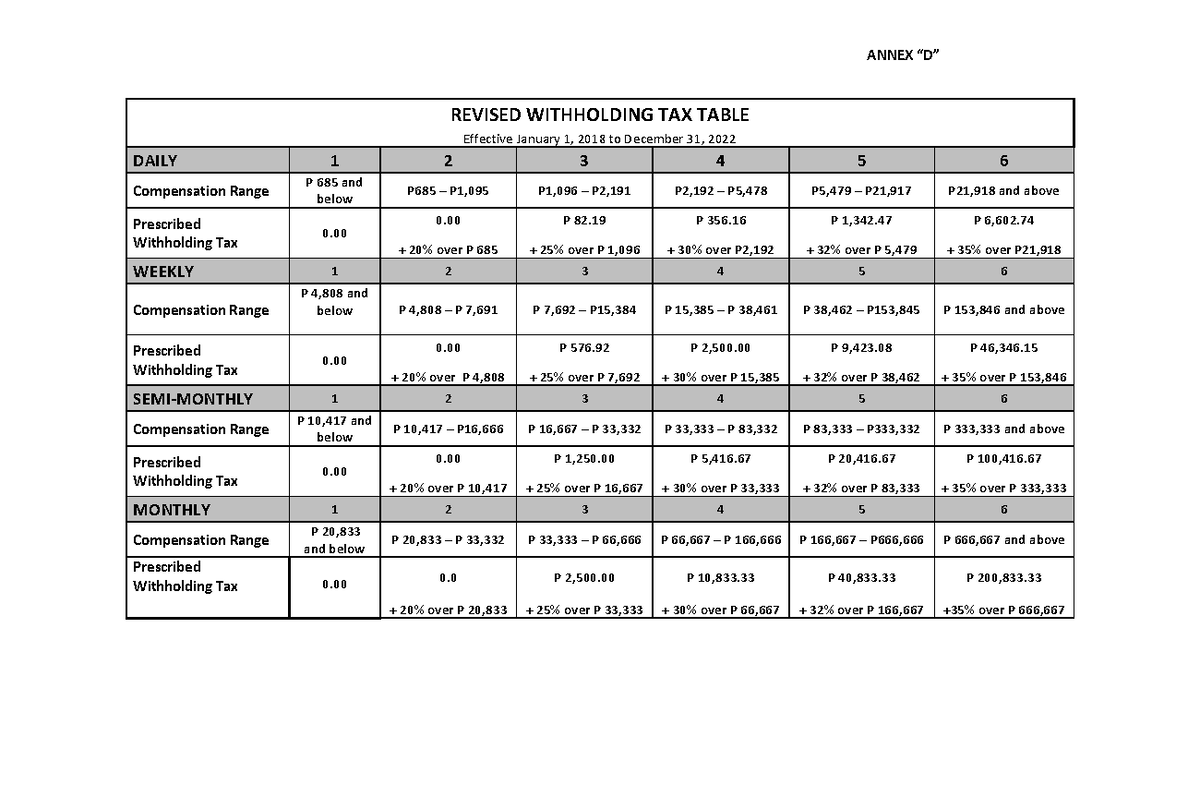

RR112018 AnnexD RevisedWithholdingTaxTable 20182022 (Philippines, This comprehensive guide to filing your 2025 itr will set you on the path to a. Income tax rate (year 2025 onwards) p250,000 and below.

TLCE Episode 3 Federal tax, You just need to enter your monthly income and then use the calculator to compute your taxable income, monthly tax due, and net. Deloitte philippines’ 2025 tax calendar details.

Here’s a rundown of key tax deadlines the bir has set for the calendar and fiscal year 2025 which includes the annual and quarterly filing schedules.